Kenyans can now borrow money for personal use and running their business in a move meant to reduce predatory lending in the country. The Hustler Fund is Kenya Kwanza’s antidote and effective immediately any Kenya with a national identity card can apply and be given, based on their credit score.

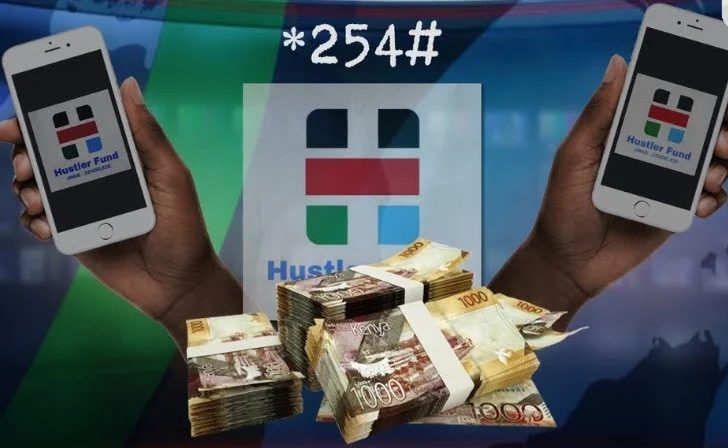

Accessing the funds is through the mobile phone and you need

to register by dialing *254# and following the instructions.

Here is what you should know about the funds;

- Eligibility; you must be a Kenyan citizen of 18 years of age and above and must have a valid national Identification Card (ID). You also must have a registered mobile number from a recognized Mobile Network Operator in Kenya i.e., either Airtel, Safaricom or Telkom and have a mobile money account i.e., either Airtel Money/M-PESA/T-Kash. The SIM card in question can/ will only be eligible if it has been in use for more than 90 days.

- Registration; You can only register one number into the Hustler Fund i.e., the customer can only opt-in once with a unique identifier as National ID. If you need to register another number, you will need to opt out of the current line. If lose your line your money is safe because your Hustler Fund account is protected by your Mobile Money PIN. Once you replace your SIM card at your Mobile Network Operator outlet, you will be able to access your Hustler Fund account using your current Mobile Money PIN.

- Products; There are four products available under the Hustler fund, these include: Personal Finance – (Ksh500 to Ksh50,000 depending on your scoring); Micro Loans; SME Loans and Start Up. The first instalment of this fund is the Personal Finance product, which has been launched.

- Personal loan; For the personal finance loan, the loan limits for this product will be a minimum of Ksh500 up to a maximum that will be determined by the borrower’s credit score and capped at Ksh50,000.00. The increase in limit will be dependent on the individual customer’s performance on consistent loan borrowing and repayment on time. The limit shall be reviewed and adjusted based on the borrowing and repayment history of previous Hustler Fund loans taken.

- Interest on personal loan; The loan interest rate is capped at 8 percent per annum computed on a pro-rated basis. This means that the money will be given out according to their (the borrower’s) share of the whole.

- What should I expect when I borrow? The approved loan will be disbursed to your Mobile Money account. Out of the total approved loan amount, on disbursement 95 percent shall be deposited to your Mobile Money wallet, and the remaining 5 percent shall be deposited to your savings account scheme of the fund. 5 percent of your loan will go into a savings scheme. The savings scheme will split savings into 70 percent long-term and 30 percent short term savings i.e., 70 percent of the 5 percent will go into long term (Pension) and 30 percent of the 5 percent will go into short term. For instance, if you borrow Ksh1,000, Ksh50 (5% *1,000) will go into their savings account as below, this being Ksh35 (70% *50) – will go to Pension account and Ksh15 (30% * 50) – will go to short term savings account.

- Processing fee: There is no processing fee.

- If you borrowed erroneously, there is no reversal. You will have to repay the loan. And the loan repayment will be made from your Mobile Money account i.e., Self-payment

- Change of number; You cannot change or transfer the loan to a new number.

- The loan will not automatically clear other loan obligations you have on the phone.

- Loan repayment; The loan repayment period is 14 days with an interest of 8 percent per annum. If you borrowed Ksh1,000, you will receive Ksh950. In 14 days, you will be expected to pay back. You may re-pay the loan as a lump sum or in part provided that the full repayment is done within 14 days. And if the loan is not repaid within the stipulated 14 days, the you credit rating is negatively affected. However, if the loan is paid in full, the loan contract is closed, and you can request another loan. All transaction notifications to the customer will be by SMS.

- You can only get one loan at a time and qualify for another loan if you Pay your loan in full. Qualified borrowers are eligible for only one loan at a time hence multiple loan borrowing on varied networks is therefore prohibited. To increase loan limit, continue using Hustler Fund and pay your loan on time. Also, assessment of credit history on subsequent loan applications and repayment shall apply to determine subsequent qualifications for the facility.