If you are thinking about starting a business in Nairobi or already have one running, you are required to comply with the county laws, one of which is having a business permit.

The county has had a change of revenue collection systems

with the Nairobi Metropolitan Services (NMS) taking over revenue collection as

certain functions were transferred

from the Nairobi City County Government (NCCG).

With the new system, the Kenya Revenue Authority (KRA)

was appointed as the principal-agent for the collection of all Nairobi City

County revenue.

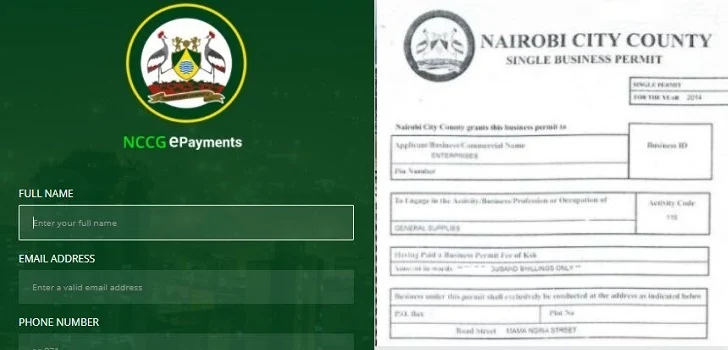

Methods of Acquiring Business Permits

There are two methods that you can use to acquire a business

permit. You can either apply online on the NCCG portal or by visiting the

KRA offices at Times Tower, Nairobi.

The cost of getting a business permit in Nairobi

The cost of applying for a business permit is dependent on

the number of employees, the type of business, and the location of the

business. For example, a small workshop of up to 5 employees is

charged Ksh 15,000 annually including a Ksh200 application fee.

The required documents include:

Copy of Certificate of Incorporation / Business

Registration Certificate

Copy of company PIN certificate

The physical address, land zone, and plot number

National ID/ passport number

Here is the procedure:

1. You will sign up on the Nairobi county self-service

portal with your details such as your email, phone number, national ID and a

pin or password.

Note that you will be using this pin/password in other

places, that is why you need to use a secure but easy-to-remember pin or

password.

2. After typing in your details, you will log in, and you

will be directed to the homepage.

3. On the website, focus on the single business permit. Here

you will click on renew.

4. After you click renew, you will be directed to the check

status page. On this page, you will be able to check your company status and

the total cost that will be needed for renewing the single business permit.

Here you will be shown the exact Nairobi City County

business permit rates in that particular business year.

This page can show you the amount that you have been

penalized in the case of late payments. Here, you will also be able to see the

previous business permits where you can print them out if need be.

4. Check thoroughly that the information is correct and that

you have not been overcharged or penalised.

5. Now fill in the business ID which can be found on the

previous business permits. Enter the year you want to renew, the amount you are

going to pay, and then click 'check status'.

6. If you are a first-time applicant, then you will notice that

your wallet is empty and hence the message that your wallet does not have

funds.

Just below the message is another tab to top up which you

will have to click and continue to top up.

7. After you have clicked top-up, you will be

redirected to the Nairobi county E-wallet, where you will be prompted to

add your phone number and the amount you want to top up (this is the

amount that you were shown earlier).

You will also need to key in your pin or password. This is

the same pin or password that you used to log in with.

8. Click 'submit'. The system will then redirect you to

a different page where you will choose your preferred payment

method.

9. Upon satisfaction with the given information, type your

PIN and submit the details.

10. The system will prompt you with two links: to print your

business permit and to print the receipt.

11. Print the permit and then download it.

12. Finally, display the downloaded business permit at the

premises as is required by the law.

For manual applications

Invoices may be obtained from Times Tower Ground Floor,

Nairobi County Cash Offices at City Hall, and at Makadara Cash Office.

Payments should be made to:

Cooperative Bank of Kenya Nairobi City County – KRA Revenue

Account - 011 417 094 100 00

National Bank of Kenya Nairobi City County – KRA Revenue

Account - 010 712 252 511 00

A person who fails or neglects to renew a licence as

required and continues to operate the business or trade commits an offence and

shall be liable on conviction to a fine not exceeding Ksh50,000 or to

imprisonment for a term not exceeding three months, or to both.

For further clarification and facilitation, you can contact the Call Centre on Tel: No 0709 014 747